Cyber Liability Insurance

Data breaches and hacks can be detrimental to any business. In today’s digital age, data breaches are becoming more common. Cyber liability insurance protects your business, and finances, in the event of a cyberattack.

The Identity Theft Resource Center reports that data breaches exposed 415 million employee and customer records in 2018 alone – and nearly half of those were considered business breaches. Cyberattacks can compromise the security of your organization, lead to financial hardship, create a lack of trust amongst your clients or employees and damage the reputation of your organization.

Cyber liability insurance helps safeguard your company from the threat of phishing emails, computer viruses, ransomware and more. Businesses that house important or sensitive customer data are even more vulnerable to these attacks, further amplifying the need for a strong cyber liability insurance policy. Small businesses are more susceptible to cyberattacks, as they typically don’t have the infrastructure of an IT department to safeguard them or mitigate attacks.

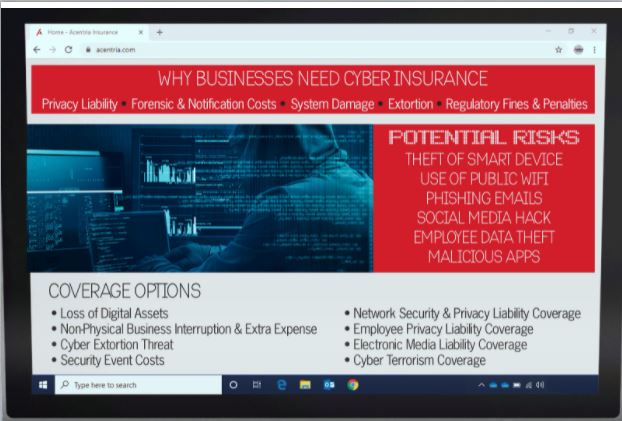

Coverage options include:

- Loss of Digital Assets

- Non-Physical Business Interruption & Extra Expense

- Cyber Extortion Threat

- Security Event Costs

- Network Security & Privacy Liability Coverage

- Employee Privacy Liability Coverage

- Electronic Media Liability Coverage

- Cyber Terrorism Coverage

Resources

For more information on cyber liability insurance, download some of our resources:

Take the Next Step

Cyber liability insurance protects and helps mitigate the associated consequences of a cyberattack for businesses.

Depending upon the policy, cyber liability insurance coverage may include liability for compromised data, business interruption, legal fees and financial losses.

Any business that stores customer or employee data and deals with sensitive information could benefit from a cyber insurance policy. Small businesses often lack an IT department or enhanced cybersecurity safeguards. It is crucial that all businesses, regardless of size, protect themselves with a comprehensive cyber insurance policy. A cyberattack can be financially devastating – and could result in business interruption or ultimately permanent closure.

A cyber insurance policy varies depending on the degree of coverage and the size of your organization. A licensed Acentria agent can help you determine the proper cyber insurance coverage for your business. Contact us to learn more.